On Friday night, Karen Clark & Company (KCC) released a study estimating the insurance losses from Hurricane Ian at $63 billion. The research was informed by prior investigations.

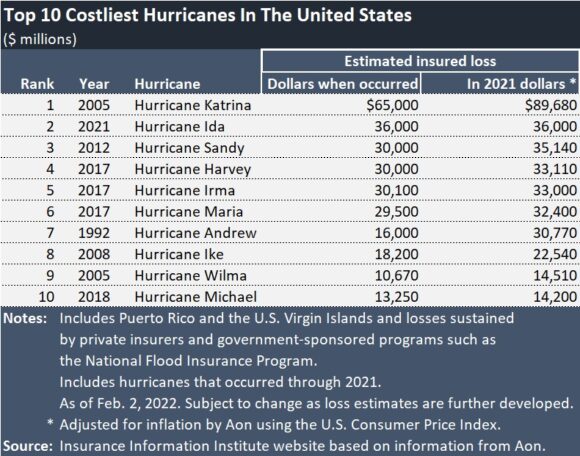

If KCC’s estimates are accurate, Hurricane Ian will be one of the costliest storms in U.S. history, despite the contribution of $200 million from the Caribbean. Despite the allocation of $200 million to the Caribbean, this will occur. The Insurance Information Institute developed a figure using data from Aon. According to this figure, Hurricane Katrina caused the largest insured losses in 2005.

As the KCC released its report, Hurricane Ian struck South Carolina near Caines, between Myrtle Beach and Charleston. Before departing, the hurricane caused damage to Florida. Ian was a Category 1 hurricane with winds of 85 mph. The 150 mph winds of Hurricane Ian struck Cayo Costa, Florida, on September 28. The storm winds reached 150 miles per hour.

The KCC’s methodology takes into account damage to homes, companies, and industries in addition to wind, storm surge, and inland flooding damage to automobiles. KCC can offer an accurate evaluation of the losses of privately insured parties. It includes coverage for building contents and time-element losses and takes Florida’s high number of lawsuits into account. Complete

The KCC does not include boat damage or NFIP reimbursement in its appraisal.

According to KCC, Hurricane Ian will be the costliest for Florida. If you don’t count uninsured properties, infrastructure damage, and recovery costs, the total economic impact will be more than $100 billion.

KCC expects insurers to pay some non-insured claims due to the “unique nature of the Florida market with a projected high number of contested claims,” which will prompt insurers to pay some non-insured claims. KCC arrived at its conclusion after analyzing the “unique characteristics of the Florida market in terms of challenged claims.” KCC expects insurers will pay some damage claims in Florida despite the state’s penchant for litigation. Coastal flooding caused by Ian poses a significant challenge for insurance companies.

According to an analysis of current patterns in claim litigation conducted by KCC, “the high number of properties with both wind and water damage may contribute to an increase in litigation.” This conclusion was reached despite the fact that laws and practices were modified to limit litigation. KCC evaluated recent claim litigation developments to reach this conclusion.

CoreLogic estimates that the severe winds and storm surge of Hurricane Ian caused $47 billion in damage in Florida alone. In addition to the home and business losses of $22 to $32 billion, the storm surge is predicted to cause an additional $6 to $15 billion in damage. According to reports, CoreLogic estimates both covered and uncovered events.

Tony Rivera takes goods from his family’s flooded car through floodwaters in Harlem Heights three days after Hurricane Ian passes through Fort Myers, Florida. On a street in Harlem Heights, The first AP photo of October Elizabeth Blackwell